Episode 1 of the "Entrepreneur's Accounting Toolbox" series

Introduction to Business Accounting

Are you an entrepreneur or aspiring to become one?

Join Irfanali Moledina, the Entrepreneurial Accountant and Managing Partner at RMI LLP, on a journey through the world of business accounting in the first episode of the “Entrepreneur’s Accounting Toolbox” series.

This guide is designed to equip business owners with the foundational knowledge required for managing their business’s financial health.

Here’s an in-depth look at basic accounting concepts crucial for entrepreneurs.

What is Accounting

Accounting isn’t just about crunching numbers. It’s your tool to manage the financial pulse of your company, ensuring everything is aligned from day-to-day activities to the bigger financial goals.

In other words, accounting is the systematic process of recording, summarizing, and reporting the myriad of transactions resulting from business operations.

It involves tracking every dollar that flows in and out, forming the bedrock of your company’s financial system.

Why is Accounting Important for Business Owners?

1. Efficient Business Management:

Effective accounting allows business owners to visualize financial implications on a daily basis—enabling them to discern what strategies succeed, identify areas needing improvement, and manage operations efficiently.

2. Tax Preparation and Compliance:

Proper accounting is indispensable for preparing tax returns, a legal requirement for all businesses. Accurate financial records ensure you’re prepared for audits, reducing the risk of discrepancies.

3. Securing Loans and Investments:

Need a loan or want investors? Accurate books and financial transparency are essential, showcasing your business’s health and making it attractive to banks and other investors.

This clarity eases the evaluation of your enterprise’s financial health and potential.

Core Accounting Concepts and Terminology

Revenue vs. Income:

Understanding the difference between revenue (top-line sales inflows) and income (bottom-line profit after expenses) is essential for evaluating business performance.

Revenue is every dollar you earn from sales—the top line. After subtracting all your expenses, you get to what we call income or profit—the bottom line.

Profit Calculation:

Profit, or net income, is what’s left after deducting expenses from revenue. It represents the true monetary gain for the period.

Record-Keeping:

This is about keeping track of every transaction—be it sales, expenses, or any financial activity—in a consistent and accurate manner. These records help maintain your understanding of where your business stands financially.

Key Financial Statements Explained

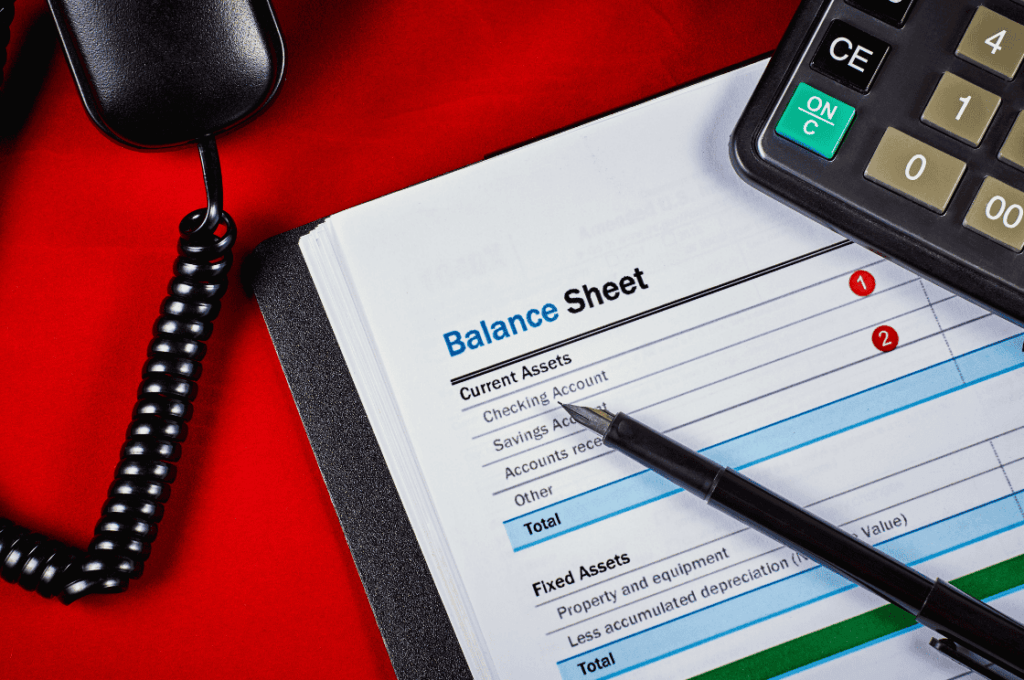

Balance Sheet

A financial snapshot at a specific point in time (what you own and owe), detailing assets, liabilities, and owners’ equity. It serves as a barometer of liquidity and financial stability.

Income Statement

This report details revenue and expenses over a designated period (or how much money came in and how much went out) —monthly, quarterly, or annually—providing insights into operational efficiency and profitability.

Cash Flow Statement

This important document explains how changes in balance sheet accounts and income affect the cash you have available.

It helps you see where your cash is coming in and going out, which is crucial for knowing how much cash you have on hand.

The document breaks down cash flow into three parts: operations, investing, and financing activities.

Accounting methodologies

Cash basis accounting

Recognizes revenue and expenses only when cash is exchanged, offering simplicity and insight into cash position.

Accrual Basis Accounting

Records revenues and expenses when they are incurred, providing a detailed view of business performance. It’s the standard for financial reporting and compliance.

Navigating Accounting Software

Save time and increase accuracy by using accounting software like QuickBooks, FreshBooks, Xero, or Sage.

These tools automate and organize your financial data, so consider one that best fits your business needs.

Accounting tips for business success

Start Early and Keep It Regular:

Build solid accounting habits from day one. Consistent record-keeping avoids future complications and helps scale your operations smoothly.Keep Your Records Updated:

Frequent updates prevent chaos. Easier audits, clear insights, and compliance are just a few benefits of regular record maintenance

Building a Strong Financial Foundation

Accounting doesn’t have to be daunting. With the right approach and tools, you can manage your finances smartly and confidently.

Strong accounting practices are integral to entrepreneurial success. By establishing a solid foundation in financial management, business owners can confidently navigate tax obligations, secure funding, and drive growth.

For further guidance, Irfanali Moledina and the RMI LLP team are here to support your journey. Reach out with any questions or for expert advice on optimizing your accounting systems

Book a Free consultation today or contact us at 403-457-4232 or info@rmillp.com.